Accuracy and Reliability of Reported Estimates

Proper pricing of carbon-intensive financial assets requires accurate pricing of attached liabilities. The too late too sudden scenario makes accurate pricing of environmental debt even more critical due to the potential for sudden acceleration of debt payments.

Pricing of environmental debt requires informed assumptions about the timing and amount of expected cash flows. These assumption underly reported accounting estimates for asset retirement obligations (AROs).

U.S. companies are required to estimate the fair value of AROs. Fair value is the price that would be paid to transfer the liability to a third party in an orderly transaction (an “exit price”). In estimating the fair value of a liability for an asset retirement obligation, a company begins by estimating the expected cash flows that reflect, to the extent possible, a marketplace assessment of the cost and timing of performing the required retirement activities. Company-reported audited financial data shows that the largest publicly traded U.S. oil companies are self-admittedly underestimating these expected cash flows. And by a lot.

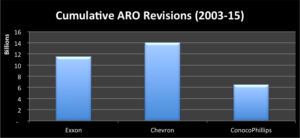

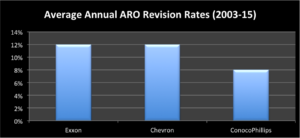

When combing through financial statement footnotes for historical information on AROs to see if and by how much they were growing over time, we stumbled upon a shocking fact. The biggest publicly traded U.S. oil companies had reported double-digit revision rates, on average, over more than a dozen years! By the year 2015, Exxon had booked ARO revision increases of $11.5 billion, compared to its inaugural 2003 ARO estimate of $3.5 billion. Think about that for second. Exxon’s cumulative revisions over 13 years are equivalent to 329% of its original estimate!

Imagine that you estimated your then five year-old daughter’s future college expenses to be $100,000 on an inflation-adjusted basis, and saved accordingly, only to discover when she is ready to enroll 13 years later that the actual cost is $429,000!

Bear in mind that AROs are not future obligations. They are present obligations arising from past events that must be settled in the future. They are long-term debts similar to a promissory note with a single payment due at maturity. However, the problem for oil and gas companies, and their investors and creditors, is that there is no fixed principal amount for the obligation and no certainty as to when it will come due.

Since 2003 the three largest U.S. oil companies have reported cumulative revisions of expected cash flows in the amount of nearly $32 billion with an average annual revision rate of 11%. The large cumulative revisions in expected cash flows and the high historical average annual revision rates suggest that these companies are incapable of accurately estimating expected cash flows to extinguish their environmental debts. Because ARO accounting estimates are self-evidently inaccurate and unreliable, an alternative approach to pricing these obligations is required.

More Information:

How Do Oil Companies Estimate Their Environmental Debts?